As the price of gold continues its ascent, and the world economic powers endeavor to outdo each other in printing fiat money, I find myself in a similar situation as value investors were in the late 1990s. Then, in the middle of the technological boom, value investors found that the stocks they cherished were spat upon by the market, and tech stocks which have no real earnings soar to great heights. Similarly, gold, with negative cash flow and no real productive value, will likely boom in the near future. I find myself sorely tempted to join the ride.

As the price of gold continues its ascent, and the world economic powers endeavor to outdo each other in printing fiat money, I find myself in a similar situation as value investors were in the late 1990s. Then, in the middle of the technological boom, value investors found that the stocks they cherished were spat upon by the market, and tech stocks which have no real earnings soar to great heights. Similarly, gold, with negative cash flow and no real productive value, will likely boom in the near future. I find myself sorely tempted to join the ride.

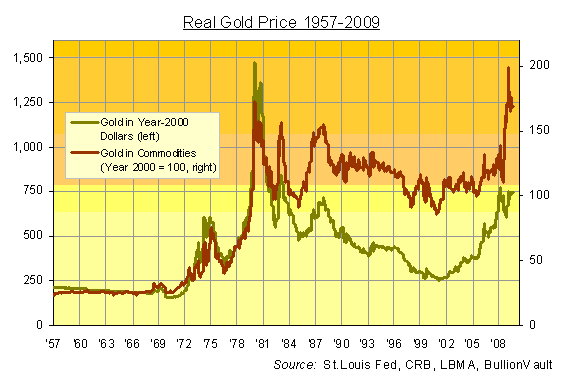

The most convincing bull case for gold is that gold can once again become a reserve currency in an era when all paper currencies are being devalued (industrial and jewelry demand for gold pales in comparison). Indeed, anecdotal reports are that many central banks around the world have begun to slow their gold sales, and may in fact be buying gold again. And of course, gold is a classic inflation hedge. The last time gold reached a peak in price is in the late 1970s, near the end of the inflationary era (see the very informative figure from the St Louis Fed). Many pundits have already pointed out that, when adjusted for inflation, gold prices are nowhere near its 1970s peak, although gold is currently at its peak based on nominal dollar pricing. However, if you look at the relationship between gold and other commodities such as oil and wheat, it is clear that gold is expensive relative to these commodities. In fact, it would make more sense for surplus nations such as China and Germany to stockpile commodities which they can use in the future, such as oil and uranium, rather than stockpile gold, or worse, paper currency that is losing value.

Due to the difficulty of valuing gold, a position in gold is necessarily a speculative play and must be constantly monitored. My preference is to look for commodity-related stocks that are undervalued as a hedge against currency devaluation. There are other methods, of course, such as Seth Klarman’s deep out-of-money options on Treasuries which will pay out only if Treasury yields spike (which will occur in a hyperinflation scenario, either as a result of a bond buyers’ strike, or the Fed increasing rates to rein in inflation). And of course, as per my previous post, I am still looking into Japanese stocks, which is expected to benefit from an inflationary environment. Failing to find some suitable hedge, I might initiate a small GLD position with a 10% trailing stop. This is not my normal procedure, as most of my positions are somewhat illiquid and 10% swings are commonplace. However, since I cannot value gold, a trailing stop would have to do.